stock option sale tax calculator

Looking to Unlock the Value. Section 1256 options are always taxed as follows.

How To Calculate Cannabis Taxes At Your Dispensary

You can also add sales expenses like real estate agent fees to your basis.

. Enter the purchase price per share the selling price per share. This rule means the taxation of profits and losses from non-equity options are not affected by how long you hold them. Subtract that from the sale price and you get the capital gains.

Ad All the Trading Tools You Need to Quickly Place Your Trades into the Market. This calculator illustrates the tax benefits of exercising your stock options before IPO. Ad We Alert Our Members To The Biggest Stock Moves Every Day Before They Occur.

Ad Fidelity Has the Tools Education Experience To Enhance Your Business. Our tools and algorithms help investors design option strategies. Net Value After Taxes.

Nonqualified Stock Options Tax Recommendations Nonqualified stock options have a pretty straightforward tax calculation eventually well build a calculator for you to use. The Stock Option Plan specifies the employees or class of employees eligible to receive options. Once youve opened it you need to provide the initial value at which the asset was bought the sale value at which you have sold it and the duration.

Trade inspiration - keep your portfolio fresh with the tastyworks follow page. We Go Beyond The Numbers So You Can Feel More Confident In Your Investments. Sign up for the latest on how to invest in Nasdaq-100 Index Options.

Review Outputs of NSO Tax Calculator. Ad Automate sales tax compliance in the programs you use with Avalara AvaTax plugins. Input details about your options grant and tax rates and the tool will estimate your total cost to exercise your grant and your net.

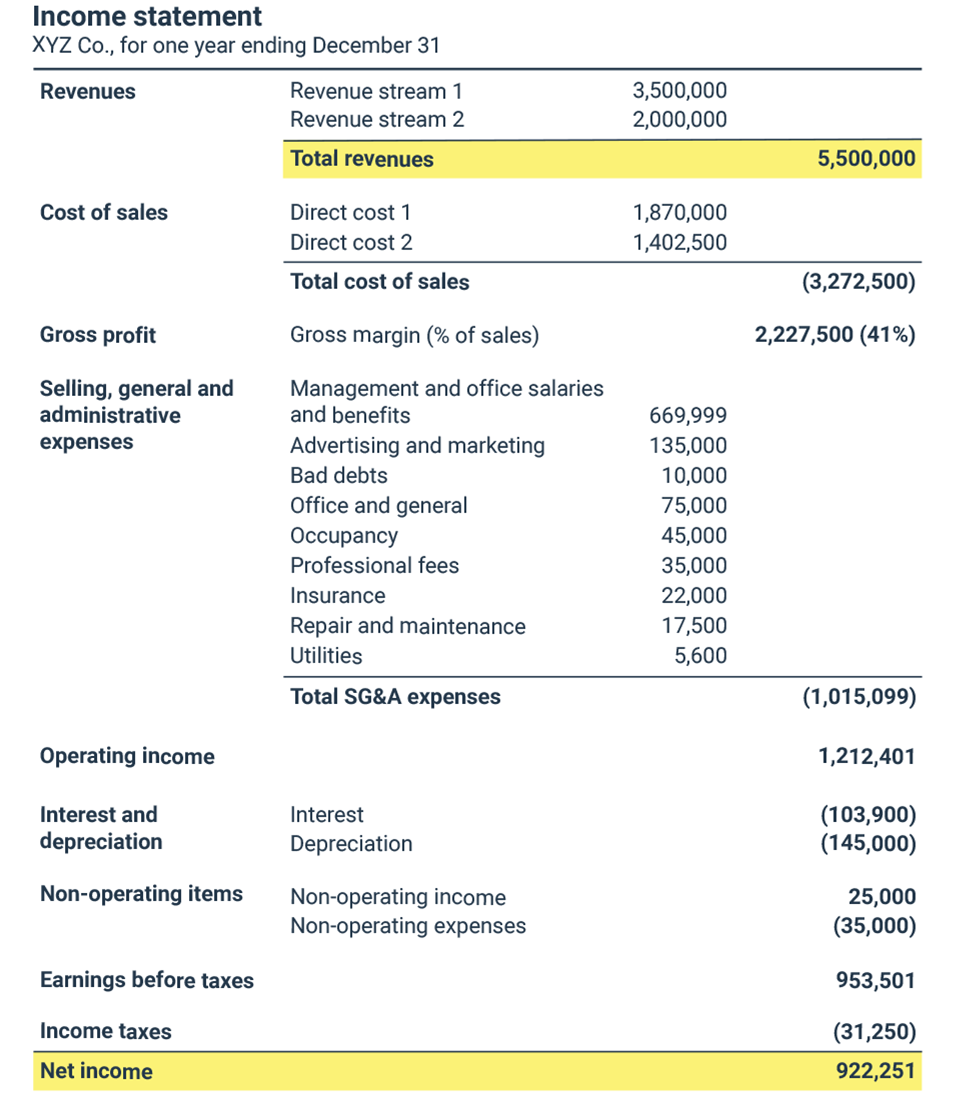

The tax rate on long-term capital gains is much lower than the tax rate on ordinary income a maximum rate of 20 on most long-term capital gains compared with a maximum rate of 37. You can find your federal tax rate here. This calculator can be used to estimate the potential future value of stock options granted by your employer.

Just follow the 5 easy steps below. The current stock price. When you sell your primary residence 250000 of.

On this page is a non-qualified stock option or NSO calculator. Ad With over 40 years experience in options trading we have a robust set of tools. Download the Free Stock Trading Guide Today and Start Trading Options.

Please enter your option information below to see your potential savings. If you sell the stock when the stock price is 10 your theoretical gain is 9 per sharethe 10 stock price minus your 1. Spend less time on tax compliance with an Avalara AvaTax plug in for your shopping cart.

Ad All the Trading Tools You Need to Quickly Place Your Trades into the Market. The Stock Option Plan specifies the total. The tool will estimate how much tax youll pay plus your total return on your non-qualified stock options under two scenarios.

Ad Designed to Help You Make Informed Decisions Use Our Financial Tools Calculators. Specify the Capital Gain Tax rate if applicable and. Use our free Stock Option Exit Calculator for a personalized.

This is an online and usually free calculator. Once all of the assumptions have been entered the NSO tax calculator will provide three outputs and they are all pretty self. The calculator requires a total of five inputs including.

The results provided are an. On this page is an Incentive Stock Options or ISO calculator. Ad Award-winning customer service - were there when you need us.

Ad Gain access to the Nasdaq-100 Index at 1100th the notional value. The Stock Option Plan was approved by the stockholders of the grantor within 12 months. Regarding how to how to calculate cost basis for stock sale you calculate cost basis using the.

Thats the 5 stock price minus your 1 strike price. Refer to Publication 525 for specific details on the type of stock option as well as rules for when income is reported and how income is reported for income tax purposes. New Tax Laws Recently there has.

On this page is an Incentive Stock Options or ISO calculator. The Stock Calculator is very simple to use. In this example well use 45 percent for federal California taxes but the actual rates depend on your situation.

The Stock Option Plan specifies the employees or class of employees eligible to receive options.

Annual Inventory Spreadsheet Track Beginning And Ending Etsy Spreadsheet Excel Excel Spreadsheets

How To Calculate Cannabis Taxes At Your Dispensary

Net Profit Margin Calculator Bdc Ca

Brochure Provided By Tinadre Merchant Services Merchant Services Credit Card Merchant Account

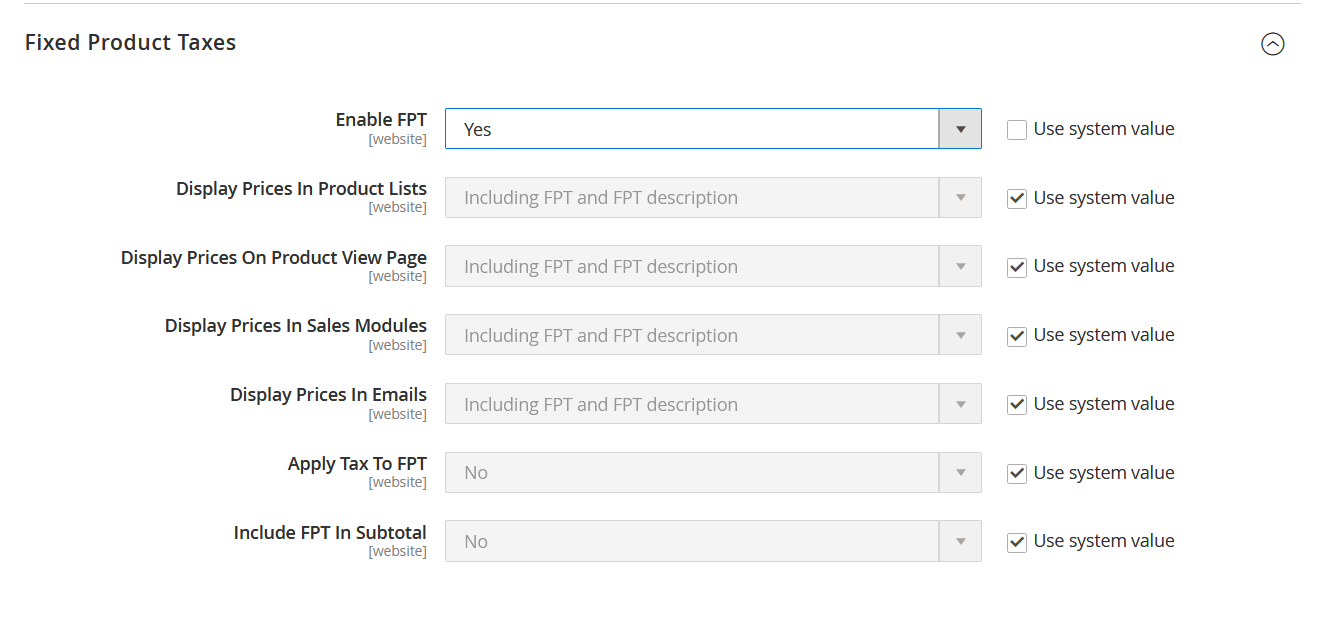

General Tax Settings Adobe Commerce 2 4 User Guide

Garage Sale Prep Checklist Free Printable Organizer For Garage Sales In 2022 Garage Sales Organization Printables Create Sign

Pro Tips 4 Tax Return Errors To Avoid With Stock Options Rsus And Stock Sales

Income Tax Prep Checklist Free Printable Checklist Tax Prep Checklist Tax Prep Income Tax

Net Profit Margin Calculator Bdc Ca

1031 Exchange How Do Sales Costs Of Dst S Compare With Traditi Investing Corporate Bonds Selling Real Estate

Free Tax Estimate Excel Spreadsheet For 2019 2020 2021 Download

Locating And Discovering Sales Tax Medical Icon Sales Tax Tax

Canada Capital Gains Tax Calculator 2022 Real Estate Stocks Wowa Ca

Reverse Sales Tax Calculator 100 Free Calculators Io

Canada Capital Gains Tax Calculator 2022 Real Estate Stocks Wowa Ca

Canada Capital Gains Tax Calculator 2022 Real Estate Stocks Wowa Ca

Calculate Income Tax In Excel How To Calculate Income Tax In Excel

Free Tax Estimate Excel Spreadsheet For 2019 2020 2021 Download

Free Tax Estimate Excel Spreadsheet For 2019 2020 2021 Download